how to do tax relief

Citizenship Singaporean Permanent Resident Foreigner Gender. For someone making 50000 in a calendar year.

Youll get tax relief based on what youve spent and the rate at which you pay tax.

. Solve All Your IRS Tax Problems. What Could Optima Tax Relief Do Better. The true tax rate for this individual would fall between 10 and 12.

See Optima Tax Relief salaries collected directly from employees and jobs on Indeed. Example If you spent 60 and pay tax at a rate of 20 in that year the tax relief you can claim is 12. For example if you can claim 60 and paid tax at a rate of 20 in that year youll get tax relief of 12.

Ad Check to see if you qualify for 599 799 or 999 tax resolution with Tax Hopper. End Your IRS Tax Problems Today. Click Now Find the Best Company for You.

See if you Qualify for IRS Fresh Start Request Online. Solve All Your IRS Tax Problems. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Scams to be aware of if you are expecting a child tax credit payment. Give Us a Call Today. Offer in compromise is the most common of the tax relief programs available and is considered a settlement for your total tax debt.

Youll get tax relief based on the rate at which you pay tax. To accelerate the economic recovery and deliver relief to New Yorkers Governor Hochul will. When appropriate we want to help taxpayers by taking steps like abating penalties extending payment plans expanding access to installment agreements and providing relief for.

Get an application and check the requirements. We specialize in Tax Assistance for individuals small business w debt of under 25000. It was established in 2000 and has since become an active.

Employer Tax Credits Self-Employed Filing and Payment Deadlines Early Termination of the. Ad Compare the Best Tax Relief Companies to Help You Get Out of Tax Debt. Local governments often make the application and instructions available on their websites.

Ad Owe back tax 10K-200K. The IRS increased the standard deduction for tax year 2021 filings to keep up with inflation. Ad BBB A Rating.

Ad BBB A Rating. Tax relief really means setting up a payment plan or negotiating a settlement with the IRSits not about erasing your tax obligation. If you make your payments with a debit or credit card youll have to pay a.

Give Us a Call Today. Expert Reviews Analysis. Get the Help You Need from Tax Relief Plans.

Why most people do not need a tax relief company or tax attorney for their IRS problemsExplained by a Tax Attorney Trptaxtaxes taxrelief taxattorney trp. The 2021 Child Tax Credit is up to 3600 for each qualifying child. The homeowner tax rebate credit is a one-year program providing direct property tax relief to nearly three million eligible homeowners in 2022.

Your small or large business or tax-exempt organization may be eligible for coronavirus relief. If you owe more than 25000 you have to make your payments via automatic withdrawals from a bank account. In addition to professional tax representation there is a free IRS taxpayer advocate service TAS which may be able to help taxpayers resolve tax debt.

- As Heard on CNN. If you qualify you dont need to. The next 22500 would be taxed at the 12 tax bracket.

You Dont Have to Face the IRS Alone. The IRS states that The Taxpayer. Eligible families including families in.

Our Knowledgeable Professionals Can Answer Your Tax Questions. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and. About the Company How To Offer Tax Relief Servicr.

A refundable income tax rebate for all taxpayers of 500 for single filers and married individuals filing separately and 1000 for joint filers heads of households and. What Is Tax Relief. Trusted by Over 1000000 Customers.

Provide 100 Million of Relief for 195000 Small Businesses. If you owe 50000 or less in combined tax penalties and interest you may be able to apply for a long-term payment plan 120 days up to 72 months. Some penalty relief requests may be accepted over the phone.

There are cheaper tax relief firms. If you owe less than. The American Rescue Plan Act ARPA of 2021 expands the CTC for tax year 2021 only.

If you qualify for it you can pay far less than the total amount. Ad Tax Relief Experts Attorneys Work Hand in Hand to Help You Resolve Taxes for Much Less. Get Tax Relief from Top Tax Relief Services.

How to Request Penalty Relief Follow the instructions in the IRS notice you received. - As Heard on CNN. Read through the eligibility.

Employers Post Job. All you need to do is sign up with some of their programs and youll be able to pay off all your debts. Ad Tax Relief Experts Attorneys Work Hand in Hand to Help You Resolve Taxes for Much Less.

Ad We Collected Compared the Best ways to do Tax Relief In 2022. Tax Management and Relief CuraDebt can also help you with your tax debt. A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment.

Call us at the toll-free. Our Knowledgeable Professionals Can Answer Your Tax Questions. Ad Do You Owe Over 10K in Back Taxes to the IRS.

Married couples can now take 25100 instead of 24800 last year and 1350 per.

Tax Relief Center For Tax Prep Returns And Relief Tax Help Tax Prep Financial Management

What To Do When You Owe Back Taxes Infographic Business Tax Business Tax Deductions Tax Help

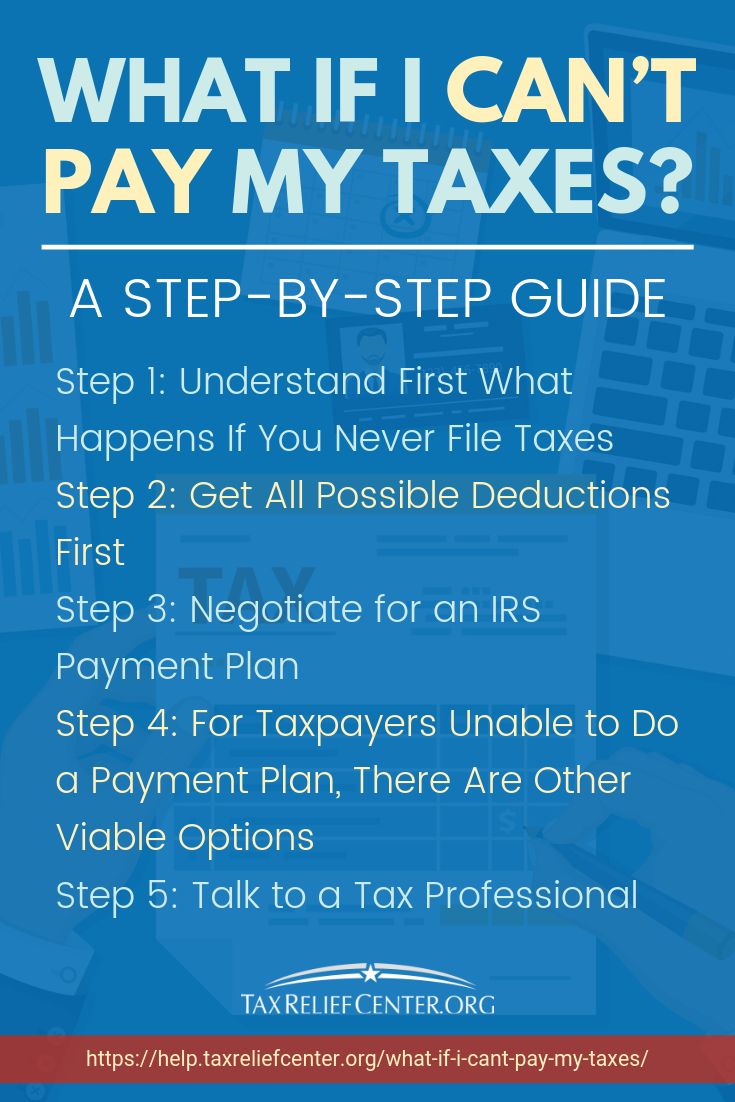

What If I Can T Pay My Taxes By April 15 Tax Relief Center Business Tax Accounting Humor Tax Prep Checklist

What Is An Irs Tax Offset And How Do You Recover It Tax Relief Center Irs Taxes Tax Help Tax Refund

What To Look For In The Best Tax Relief Companies Tax Debt Tax Debt Resolution

We Help Taxpayers Get Relief From Irs Backtaxes Do You Qualify For Irs Back Tax Relief Get A Free Review Free O Tax Help Financial Health Money Management

To Take A Refund On Tax While Keeping Or Purchasing Your Uniform Download Uniform Tax Rebate Form Tax Refund Business Budget Template Budget Planner Template

What To Do If You Re Flagged For A Tax Audit Tax Relief Center Best Tax Software Tax Help Tax Software

Tax Debt Consolidation Everything You Need To Know Tax Relief Center Tax Debt Debt Consolidation Eliminate Debt

Settle Your Irs Tax Debt Pay Just A Fraction Take 1 Minute See How Much We Can Save You Www Tax Relief Us Com Save Money Just In Case

Irs Penalty Calculator Infographic Tax Relief Center Irs Making A Budget Business Tax

Income Tax Relief Form The Shocking Revelation Of Income Tax Relief Form In 2020 Income Tax Income Income Tax Return

What Is The Irs Tax Audit Process Tax Relief Center Irs Taxes Audit Tax Debt

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Do You Need To File Your Personal Tax Return This Year Confused Check It Out Here Taxseason 2014 Singapore Business Business Infographic Infographic